Clean Rounding to €0.05 with VAT

Purpose

In some scenarios, it is useful to adjust the tax-excluded price (HT) of a product or service so that the final tax-included price (TTC) rounds exactly to a multiple of €0.05. This “clean” rounding is especially relevant where price aesthetics or accounting simplicity is important, such as in point-of-sale environments.

Advantage of the Approach

This approach considers VAT multiplication upfront, ensuring that the final TTC price, once rounded to two decimal places, is an exact multiple of €0.05.

The trade-off is accepting a slight modification of the original HT price to achieve that clean result.

Next HT Multiple of €0.05

This function finds the next HT price that, when multiplied by the VAT rate, results in a TTC price that rounds to a multiple of €0.05.

SQL Function

CREATE OR REPLACE FUNCTION get_next_ht_multiple_05(ht numeric, taxes numeric)

RETURNS numeric AS $$

DECLARE

current_ht numeric := ceil(ht * 100) / 100;

ttc numeric;

steps integer := 0;

max_steps integer := 100;

BEGIN

LOOP

EXIT WHEN steps > max_steps;

ttc := round(current_ht * taxes, 2);

IF mod(ttc * 100, 5) = 0 THEN

RETURN current_ht;

END IF;

current_ht := current_ht + 0.01;

steps := steps + 1;

END LOOP;

RETURN ht; -- fallback if nothing is found

END;

$$ LANGUAGE plpgsql IMMUTABLE;

Example with 21% VAT

The get_next_ht_multiple_05 function is applied across a price range from €0.00 to €100.00, in steps of €0.01. For each HT price, we check if within the next 100 cents, there is a value that results in a TTC rounded to a multiple of €0.05.

VAT used: 1.21 (i.e., 21%) Criteria: round(HT × 1.21, 2) mod 0.05 = 0

Result

- Total tested: 10,001

- Unchanged (no adjustment needed): 2,001

- Adjusted HT prices: 8,000

- Maximum HT deviation: -€0.12

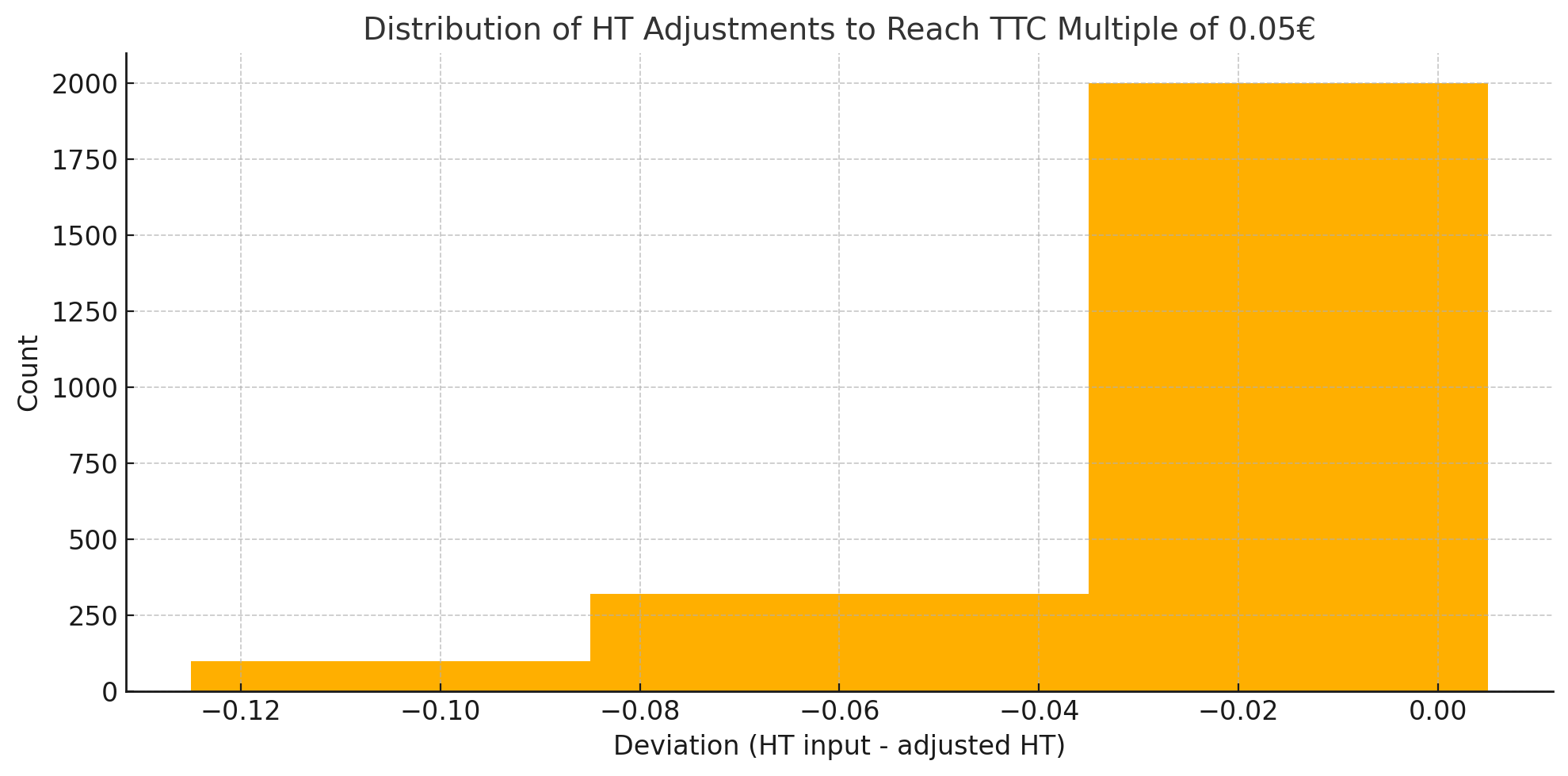

Deviation Analysis

| Deviation | Count |

|---|---|

| -0.12 | 100 |

| -0.11 | 100 |

| -0.10 | 100 |

| -0.09 | 100 |

| -0.08 | 320 |

| -0.07 | 320 |

| -0.06 | 320 |

| -0.05 | 320 |

| -0.04 | 320 |

| -0.03 | 2,000 |

| -0.02 | 2,000 |

| -0.01 | 2,000 |

| 0.00 | 2,001 |

Nearest HT Multiple of €0.05

A more advanced version could search in both directions (up and down) to find the closest TTC-rounded price to the original HT.

This would minimize deviation from the original HT while still achieving the goal of clean TTC rounding.

SQL Function

CREATE OR REPLACE FUNCTION get_nearest_ht_multiple_05(ht numeric, taxes numeric)

RETURNS numeric AS

$$

DECLARE

step numeric := 0.01;

i integer := 0;

max_steps integer := 100;

up_ht numeric;

down_ht numeric;

ttc numeric;

BEGIN

LOOP

EXIT WHEN i > max_steps;

up_ht := round(ht + (i * step), 2);

ttc := round(up_ht * taxes, 2);

IF mod(ttc * 100, 5) = 0 THEN

RETURN up_ht;

END IF;

IF i > 0 THEN

down_ht := round(ht - (i * step), 2);

IF down_ht > 0 THEN

ttc := round(down_ht * taxes, 2);

IF mod(ttc * 100, 5) = 0 THEN

RETURN down_ht;

END IF;

END IF;

END IF;

i := i + 1;

END LOOP;

RETURN ht; -- fallback if nothing is found

END;

$$ LANGUAGE plpgsql IMMUTABLE;

Example with 21% VAT

The get_nearest_ht_multiple_05 function is applied across a price range from €0.00 to €100.00, in steps of €0.01. For each HT price, we check if within the next 100 cents, there is a value that results in a TTC rounded to a multiple of €0.05.

VAT used: 1.21 (i.e., 21%) Criteria: round(HT × 1.21, 2) mod 0.05 = 0

Result

- Total tested: 10,001

- Unchanged (no adjustment needed): 2,001

- Adjusted HT prices: 8,000

- Maximum HT deviation: -€0.06 or +€0.06

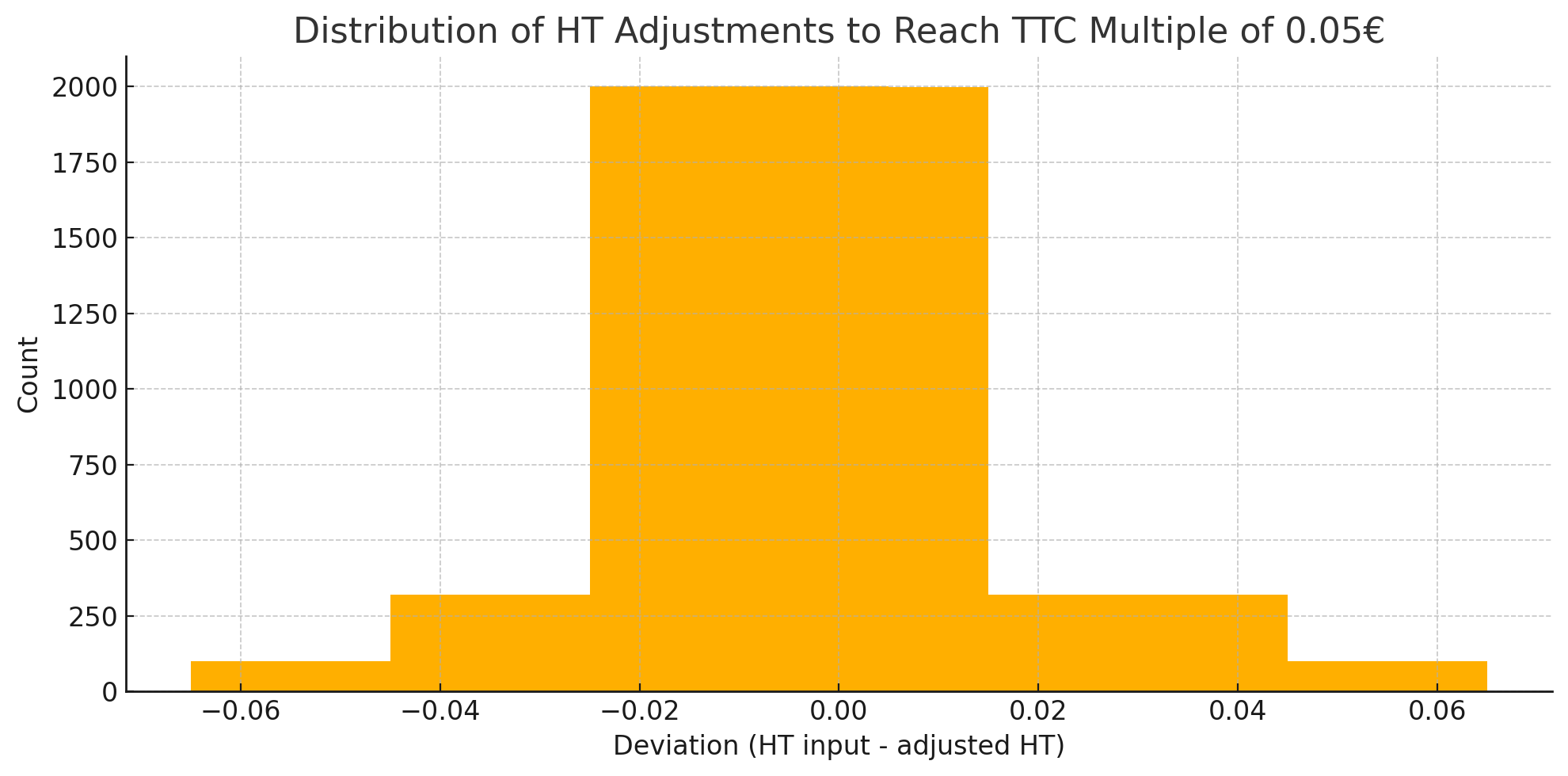

Deviation Analysis

| Deviation | Count |

|---|---|

| -0.06 | 100 |

| -0.05 | 100 |

| -0.04 | 320 |

| -0.03 | 321 |

| -0.02 | 2,000 |

| -0.01 | 2,000 |

| 0.00 | 2,001 |

| 0.01 | 1,999 |

| 0.02 | 320 |

| 0.03 | 320 |

| 0.04 | 320 |

| 0.05 | 100 |

| 0.06 | 100 |